Qatar Gratuity Calculator: Your Essential Tool for End of Service Benefits

End of Service Gratuity Calculator

As per Qatar Labour Law (Article 54)

QAR

0 years, 0 months

Your Gratuity Amount

0.00

QAR

For Full Years:

0.00 QAR

For Extra Months:

0.00 QAR

Formula: Basic Wage ÷ 30 × 21 × (Years + Months/12)

Table of Contents

If you’re working in Qatar, understanding your end of service gratuity entitlements is crucial for financial planning. Our Qatar End of Service Gratuity Calculator helps you accurately determine what you’re legally owed according to Qatar Labour Law when your employment ends. Whether you’re an employee planning your future or an employer ensuring compliance with labour regulations, this calculator provides precise calculations based on Article 54 of the Qatar Labour Law, factoring in your basic wage and total service period to give you the exact gratuity amount you’re entitled to receive.

What is End of Service Gratuity in Qatar?

End of Service Gratuity (also called End of Service Benefits or EOSB) is a mandatory financial compensation that employers in Qatar must pay to employees upon termination of their employment contract. This benefit is enshrined in Qatar’s Labour Law and serves as a form of financial security for workers who have completed their service with a company.

Why Is Calculating Your Gratuity Important?

Understanding your gratuity entitlements helps you:

- Plan your finances before leaving a job

- Ensure you receive the correct amount from your employer

- Budget properly for your transition period

- Know your rights under Qatar Labour Law

- Avoid disputes during your final settlement

How to Use Our Qatar Gratuity Calculator

Our calculator makes determining your gratuity amount simple and straightforward:

- Enter Your Basic Wage – Input your monthly basic salary in QAR (Qatar Riyal)

- Select Your Start Date – Choose the date you began working with your employer

- Select Your End Date – Enter the last day of your employment

- Click “Calculate Gratuity” – The calculator will automatically determine your service duration and gratuity amount

The calculator will display:

- Your total service period in years and months

- The total gratuity amount you’re entitled to

- A breakdown showing payments for full years and extra months

- The formula used for the calculation

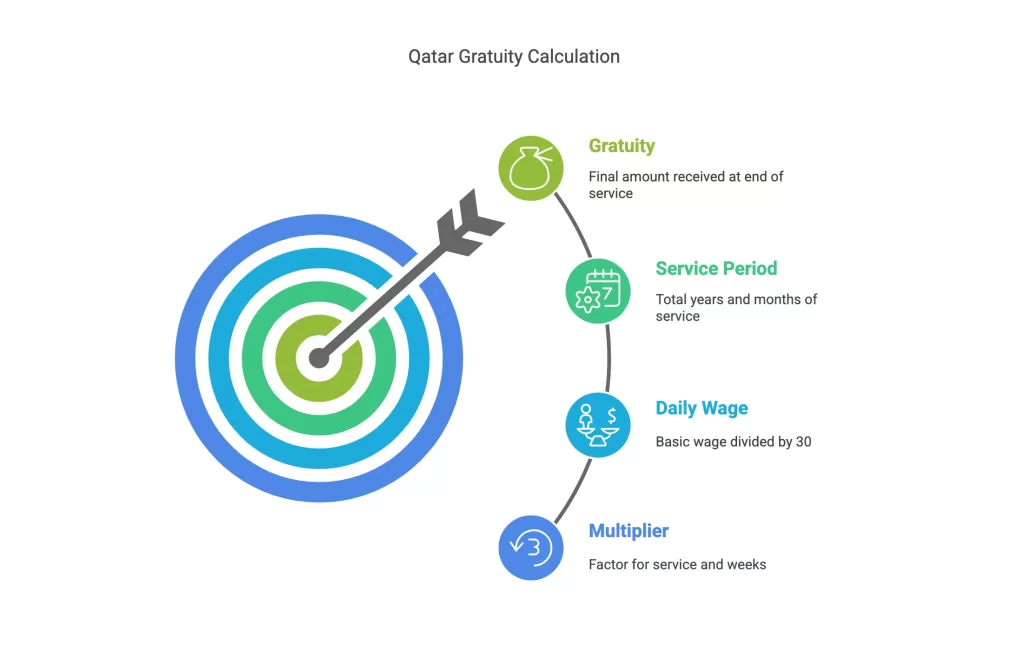

Understanding the Qatar Gratuity Formula

According to Article 54 of Qatar Labour Law, end of service gratuity is calculated using this formula:

Gratuity = (Basic Wage ÷ 30) × 21 × (Years of Service + Months/12)

Breaking this down:

- Your basic wage is divided by 30 to determine your daily wage

- This daily wage is multiplied by 21 (representing three weeks’ pay)

- The result is then multiplied by your total service period in years (plus any extra months calculated as a fraction of a year)

Example Calculation

Let’s say you earn a basic wage of 10,000 QAR per month and have worked for 5 years and 3 months:

- Daily wage = 10,000 ÷ 30 = 333.33 QAR

- Three weeks’ pay = 333.33 × 21 = 7,000 QAR

- Service period = 5 + (3/12) = 5.25 years

- Total gratuity = 7,000 × 5.25 = 36,750 QAR

Important Considerations About Qatar Gratuity Payments

Eligibility Requirements

To be eligible for end of service gratuity in Qatar:

- You must have completed at least one year of continuous service

- You must not have been terminated for reasons stated in Article 61 of the Labour Law

Pro-rated Calculations

If you’ve worked for partial years, your gratuity is calculated proportionally. For example, if you’ve worked for 3 years and 6 months, you’ll receive gratuity for 3.5 years of service.

Maximum Gratuity Limits

While there’s no specified maximum limit for gratuity payments in Qatar’s Labour Law, the amount is directly proportional to your basic wage and length of service.

Tax Implications

End of service gratuity payments in Qatar are generally tax-free, as Qatar does not impose personal income tax.

Recent Changes to Qatar’s Labour Law

Qatar has introduced several labour reforms in recent years that affect workers’ rights and benefits. While the basic gratuity calculation formula remains unchanged, these reforms have improved worker protections overall. Always check for the most current regulations when calculating your benefits.

Tips for Ensuring You Receive Your Full Gratuity

- Keep accurate records of your employment dates and salary information

- Review your employment contract for any specific gratuity provisions

- Calculate your entitlement independently before your final settlement

- Discuss any discrepancies with your HR department promptly

- Understand what constitutes ‘basic wage’ in your compensation package

When Gratuity May Be Reduced or Withheld

Under certain circumstances, your gratuity amount might be affected:

- If you resign before completing five years of service, your gratuity may be subject to deductions

- If you’re terminated for misconduct as defined in Article 61, you may not be entitled to gratuity

- If you have outstanding loans or advances from your employer, they may be deducted from your gratuity

Resolving Gratuity Disputes

If you believe your gratuity has been incorrectly calculated or wrongfully withheld:

- First, discuss the matter with your employer’s HR department

- If unresolved, you can file a complaint with the Ministry of Administrative Development, Labour and Social Affairs (MADLSA)

- The labour dispute resolution committee will review your case and make a determination

Frequently Asked Questions

1. Is gratuity calculated on basic salary or total salary in Qatar?

End of service gratuity in Qatar is calculated based on your basic wage only, not your total salary package. Additional allowances such as housing, transportation, or food allowances are typically not included in the calculation unless specifically mentioned in your employment contract. This is an important distinction, as many employees mistakenly assume their full salary package will be used for gratuity calculations. Always check your employment contract to confirm what constitutes your “basic wage” for gratuity purposes.

2. Do I still get gratuity if I resign from my job in Qatar?

Yes, you are still entitled to gratuity if you resign, but the amount may be reduced depending on your length of service:

- If you resign before completing 5 years of service:

- With 1-2 years of service: You receive 1/3 of the gratuity amount

- With 2-3 years of service: You receive 2/3 of the gratuity amount

- With 3-5 years of service: You receive the full gratuity amount

- If you resign after completing 5 years of service: You receive the full gratuity amount regardless

This graduated scale is designed to encourage employee retention while still providing benefits for shorter terms of service.

3. Is end of service gratuity taxable in Qatar?

No, end of service gratuity payments in Qatar are not subject to taxation. Qatar does not impose personal income tax on salaries or benefits, including gratuity payments. This means that the entire gratuity amount calculated is what you will receive, without any tax deductions. However, if you are planning to transfer this money to your home country, you should check the tax implications there, as some countries may tax foreign income or benefits.

4. Can my employer refuse to pay my gratuity if I have outstanding loans?

Your employer can deduct any documented and agreed-upon debts you owe directly to them from your gratuity payment. This includes salary advances, loans provided by the company, or other financial obligations you have with your employer that are properly documented. However, your employer cannot refuse to pay your gratuity entirely. They must provide you with a detailed statement showing the full gratuity amount and any deductions made. If you believe deductions are being made incorrectly, you have the right to dispute this through Qatar’s labour dispute resolution system.

Conclusion

Understanding your end of service gratuity entitlements is an essential part of working in Qatar. Our calculator provides a quick and accurate way to determine what you’re owed according to Qatar Labour Law. By knowing your rights and entitlements, you can ensure a smooth transition when your employment ends and avoid unnecessary disputes with your employer.

Disclaimer

This calculator and information are provided for general guidance only and do not constitute legal advice. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the calculator or the information contained on this page.

The calculation is based on our understanding of Article 54 of Qatar Labour Law as it stands at the time of publication. Labour laws and their interpretation may change over time. We recommend consulting with a legal professional or Qatar’s Ministry of Administrative Development, Labour and Social Affairs for the most current information regarding your specific situation.

Employers and employees should always refer to the official text of the Qatar Labour Law and seek professional advice for specific cases.